August 2025 - Market Stats

- marketing37571

- Sep 8, 2025

- 5 min read

What Trends are we Seeing?

The only time we know when we have hit bottom is when the recovery has commenced. We are currently in, the second worst real estate recessions encountered. August was no exception, posting near record figures, not in a good way. We cannot hide from the fact that August 2025 was the second worst month in 25 years with respect to numbed of transactions. Note however, it is an improvement by 2.35 per cent compared to August 2024. Inventory figures have continued to climb with August 2025 setting a record in terms of active listings at 27,485 (a 22.37 per cent increase over last year).

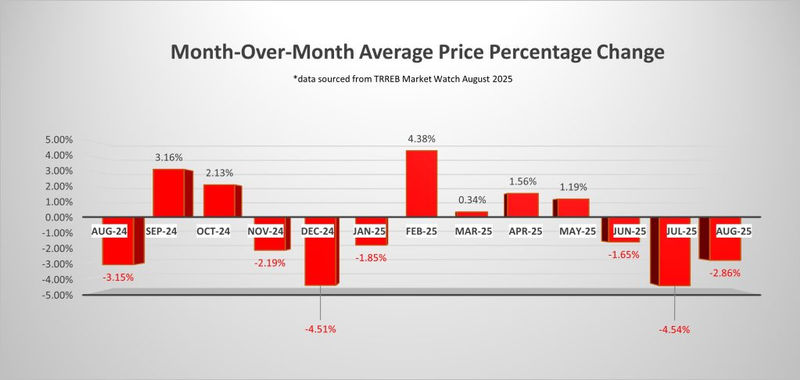

From an average sales price perspective there was a drop of 1.15 per cent on a month-over-month basis indicative of a plateaued figure. Looking year-over-year, we see a drop of 5.15 per cent which is more significant. If comparing to peak of February 2022, average prices are now 25.35 per cent lower. Some of you may recall that during the lead up to February 2022, economists were projecting the real estate market to be between 20 to 30 per cent overvalued. Buyer’s seeing improved affordability along side a stronger negotiation position have been entering the market to accomplish their real estate goals.

It is important to note that the statistics which make headlines shouldn’t drive decisions. Depending on the geographic location you are looking to transact in real estate along with the market segment, the next steps can vary substantially. For example, keep in mind the following:

68 per cent of active inventory in the City of Toronto is condos and townhomes

Breaking the City of Toronto down in terms of buyers, balanced or seller’s market we find the following

Buyer’s market for condos

Balanced market for detached homes

Seller’s market for semi-detached homes

Even within the condo market we see some move quickly if they have enough “wow” factor to grab a buyer’s attention. In Toronto and the Greater Toronto Area (GTA) when we hear of price declines and increased inventory it can feel like the sky has fallen and the pendulum of power is shifting rapidly. It is important to keep in mind that affordability continues to be challenging for most with sellers still extracting relatively high figures for the sale of their assets. The average GTA detached home price is $1,312,240 and the average City of Toronto home price is $1,524,066.

What Lies Ahead?

The unemployment figures stole the headlines recently posting a 7.1 per cent unemployment rate. The markets, depending on when you’ve looked, priced in between 80 to 92 per cent chances of a Bank of Canada (BoC) interest rate adjustment of 25-basis points which would bring the bank rate to 2.5 per cent. The Federal Reserve which holds a dual mandate of unemployment and inflation has just seen the highest unemployment rate in recent years and the markets have a 100 per cent chance of a rate adjustment for the U.S. (also on September 17th like BoC).

The Gross Domestic Product (GDP) figures for Q2 2025 came in at an annualized decrease of 1.6 per cent which supports a BoC adjustment to the interest rate.

On September 16th inflation figures will be released. While headline inflation has been below two per cent (BoC target), the core inflation figure has been sticky at around three per cent over the last several months. It is interesting to note however, that if you look at a three-month rolling average of the CPI Trim and CPI medium the figure is 2.4 per cent. This may be the comfort the BoC is looking for to adjust rates if the trend continues.

With the Federal Reserve looking to make up to three downward adjustments in their interest rate before the end of the year, some believe that Canada will mirror this which would bring the prime lending rate to 2.0 per cent. While the downward trend will be welcomed by many, it isn’t necessarily going to be the spark to ignite the real estate market. Consumer confidence is needed and the ingredients to ingrain that into people’s decision-making process will require a stable trade agreement with the U.S., stronger employment numbers and signs of economic growth/investment indicating that the country is on the right track.

For buyers, despite ongoing drops in average price from one month to the next, we continue to encourage exploration for the right opportunity. We underscore that this be done with a five-to-10-year horizon of ownership so that immediate fluctuations can be erased by longer term price escalations. Depending on the purchase you are looking to make, we don’t want you looking in the rear-view mirror saying, “I wish I had”. Keep in mind, exploration of opportunities is not a commitment to purchase, just ensuring educated decisions are made with no opportunity missed.

For sellers, while the process may feel very different than 2020 to 2022, the end result of accomplishing your goals can still be achieved. The decision to sell now versus wait often requires the input of various factors; inclusive of where you are going to if you are moving from your primary residence. The headlines may seem bleak, and the figures are real, yet just last week we saw multiple offers on a two million dollar property (you just never know!).

What is Happening with Sale Prices

Sale Price Comparison | ||||

|---|---|---|---|---|

Product Type | Changes from August 2024 to August 2025 | Changes from July 2025 to August 2025 | ||

Toronto | GTA | Toronto | GTA | |

Detached | -10.0% | -6.9% | -3.3% | -3.1% |

Semi-Detached | -6.1% | -4.9% | +0.3% | -8.9% |

Townhouse | +1.0% | -5.1% | +2.1% | -0.5% |

Condominium | -2.0% | -10.6% | +0.8% | -2.4% |

Number of Transactions Trend When comparing August 2025 to August 2024, we saw the following trend:

Categories | August 2025 | August 2024 | Percentage Change |

Number of Transactions | 5,211 | 5,092 | +2.3% |

Number of New Listings | 14,038 | 12,837 | +9.4% |

Number of Active Listings | 27,495 | 22,469 | +22.4% |

When comparing August 2025 to July 2025, we saw the following trend:

Categories | August 2025 | July 2025 | Percentage Change |

Number of Transactions | 5,211 | 6,100 | -14.6% |

Number of New Listings | 14,038 | 17,613 | -20.3% |

Number of Active Listings | 27,495 | 30,215 | -9.0% |

Looking into the different geographic pockets of Toronto and the GTA we notice the following changes in number of transactions when comparing August 2025 year-over-year to August 2024 and month-over-month to July 2025. The breakdown per area and product type are as follows:

Number of Transactions Comparison | ||||

Product Type | Changes from August 2024 to August 2025 | Changes from July 2025 to August 2025 | ||

GTA | TORONTO | GTA | ||

Detached | +10.5% | +4.7% | -20.6% | -11.6% |

Semi-Detached | +18.0% | -4.4% | -37.7% | -17.4% |

Townhouse | +9.4% | +0.8% | -19.5% | -9.2% |

Condominium | -3.4% | -7.7% | -13.4% | -12.6% |

Footnote: Source of statistical data is from the July 2025 and August 2025 Market Watch report of the Toronto Region Real Estate Board (TRREB) MLS.

A – Monthly Percentage Change in the Number of Units Sold

B – Month Over Month Average Price Percentage Change

C – Seasonally Adjusted Month Over Month Average Price Percentage Change

D – Monthly Percentage Change in Average Sale Price

Comments